Entrepreneurial Personal Finance: A Contrarian Investment Strategy

Personal finance when you’re self-employed vs. when you have a steady salary is a different, and much more interesting, beast.

Managing your money with an income is fairly easy. You keep a certain amount in your checking account, pay down debt, then save or invest the rest. The investment strategy is easy: go with a diversified collection of stocks and bonds as I explain in my “personal investing for 20 something’s” article.

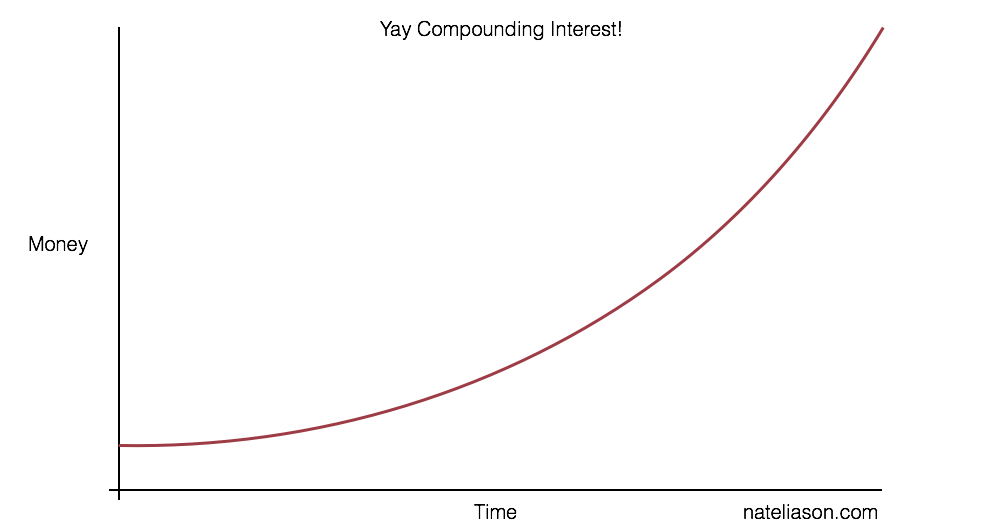

While the “make safe compounding interest” investment advice is extremely popular and should be followed by 99% of people (probably including you), it breaks down in one important case: when you can better invest that money yourself.

I don’t mean investing it into stocks and bonds of your choice, that’s usually a terrible idea, but rather when you can leverage it in entrepreneurial projects or businesses that have the potential to pay you back significantly faster than a long term investment.

Now, again, this isn’t for most people, and part of the reason this long-term investing advice exists is to protect would-be entrepreneurs from themselves. Many people given $20,000 would invest it in something that ends up going nowhere and lose all of it.

But if you have some experience taking advantage of your money in creative ways, then maybe this strategy is for you.

Self Investing vs. Long Term “Safe” Investing

The goal of this investment strategy: take as much advantage as possible of your money through investments you can make on your own, instead of waiting 20 years for the “safe” payout.

For example, let’s say you have $4,000 sitting around. If you put it in a diversified set of stocks and bonds and get a standard year over year payout of 6%, then in 12 years you’ll double your money, and in 19 years you’ll triple it.

This is great for most people, but not if you can use that money better yourself.

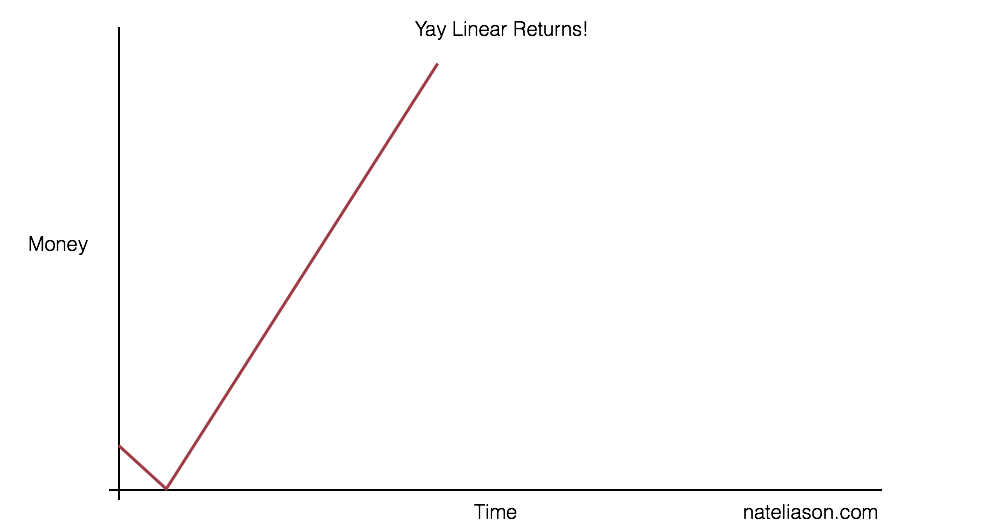

I picked $4,000 because that was roughly what it cost me to get Stamena built. I spent $4,000 to get this asset, an app that I could theoretically sell for about $4,000, but that also pays me whenever someone buys or upgrades it.

Having played with the pricing, it now earns ~$120-160 a day with no additional work from me. If we say $140 on average, then in 57 days I double my money, and in 86 days I triple it. 3 months versus 19 years, not bad.

What this made me realize was that I was putting all of this money into the stock market when I could be using it significantly better myself. Some of it could be going to products similar to Stamena, some could be going to outsourcing and hiring, but either way it didn’t make sense to keep putting this money into long-term assets when I could use it better myself.

In fact, none of the projects I’ve invested in during the last year have lost money. Stamena is on track to make significantly more than the investment, Programming for Marketers has a massive ROI, this site breaks slightly above even despite barely being monetized, and while I certainly don’t think I’m infallible, I think this strategy works when you have some idea what you’re doing entrepreneurially.

With that, here’s the new personal finance model I came up with.

Personal Finance for the Self Investing Entrepreneur

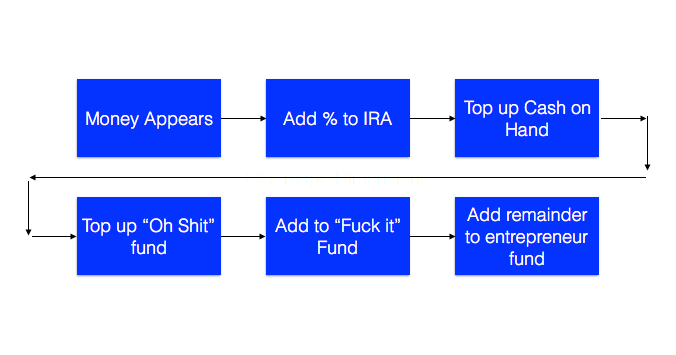

This is the strategy I’m using with all of my money now, having pulled most of it out of long-term investments except for my IRA. The strategy starts out mostly the same as common personal investing advice, with one big twist at the end.

And of course, I put together a spreadsheet to help you keep track of all of this (all yours, no email necessary).

Step 1: The Cash on Hand

First, you need to assess your burn rate (or your soon-to-be burn rate based on the runway calculator). This is the rough amount you’re spending each month. Be conservative with it, it’s better to have extra money left over than to not have enough.

Then from that burn rate you can figure out what a comfortable amount of cash in the bank is for you. For me, that’s 6 months of burn since my income has a high variability, but you might be comfortable with less or prefer more.

This is your “Cash on Hand.” I have one bank account dedicated to this through Chase.

Step 2: The “Oh Shit Fund”

Next, set your “Oh Shit Fund” amount. This is for when you’re making less than your burn and need to top up your cash on hand amount. It’s also a buffer in case you have a huge sudden expense like a trip to the hospital.

I put this at 3 months of burn, but you can set it how you want. I use my Chase Savings account for this.

Step 3: The “Fuck it Fund” (Optional)

The third bank account is optional but very fun to have. I call it the “Fuck it Fund.”

This is money you periodically save away so that if you want to do something silly and not remotely financially intelligent, you can do so without feeling guilty.

Want to buy a last minute plane ticket to go see your friend for a weekend? Fuck it!

Want to get your girlfriend a $500 bag? Fuck it!

Want to buy a Boosted Board? Fuck it!

You can deposit money to this manually, but I like using Digit since they sneak money out of my checking account without me noticing, and then when I go look at it I always get a nice surprise about how much is there.

Then if you go do something that falls in the “fuck it” category, you transfer the money back.

Step 4: The Long Term Investment

I’m cutting long term investment back significantly, but not ditching it completely. I still have an IRA with Wealthfront (as explained in my investing article), and depositing a percentage of my monthly income. 5% for now.

The advantage here is that it’s money that would be extremely expensive to take out, so I won’t touch it for 40+ years. This is the insurance of last resort in case I blow everything up.

Step 5: The Entrepreneur Fund

Up until this step, everything has been in line with conventional personal finance wisdom. What comes next is where it gets interesting.

Normally, if you had anything left after all of these were filled (and maybe a wedding fund, paying off college debt, etc) you’d put it into another stock account and let it sit and grow.

I suggest something different: since you can use the money better yourself, create another bank account specifically for your entrepreneurial endeavors.

This is not necessarily a business bank account, but rather a place to aggregate the money you’re going to spend on all of your projects. So if you want to build an app, hire an assistant, or anything else, it comes out of this account.

Now here’s where it gets fun. Your goal with the other accounts is to keep them topped up and growing, but your goal with this account is to keep it as low as possible.

Keep enough in for your recurring expenses, but as an excess builds up you want to start thinking about how you can apply it to your next project.

This could be saving it up for something you want to do, or letting it grow to a point and then seeing what you want to do with it. Either way, you want to make sure it’s being used strategically and not getting tucked under a mattress.

And some of it will end up getting lost with no return, yes, but consider that the price of learning and necessary losses to allow the gains. Especially if you’re young and have less to worry about, you’ll learn more burning some money on failed projects than trying to hoard everything away.

Should You Do This?

Here’s the most important part: you have to be careful about following this advice.

Plenty of people dump all of their money into projects that go nowhere, not realizing when they should kill what they’re working on and move on, and not realizing how to make money from what they’re doing.

If you’re working a 9-to-5 and have no entrepreneurial experience, then you should probably stick to the stocks. Or do 90% in the slow safe long term investments, 10% in projects.

And if you’ve never made money from your own projects, don’t start with a massive investment. Do something small first to get the hang of it, even a quick weekend project like Fratboxes to get your feet wet. Don’t go all in when you’re not sure what you’re doing.

But if you have the time and means to do your own projects, then the “slow and steady” investment advice might not apply to you. Try putting that money to work on your own projects instead.

Appendix: Objections

There are a few very respectable objections to this idea that I wanted to address too.

Objection 1: But Compounding Gets Better with Time

You can say “okay, but if you extend the original investment out to 40 years then it will have 10x’d your money!” and that’s part of the beauty of compounding interest, but I can get also get a 10x this way in 286 days, well under than a year.

The rate of return doesn’t accelerate, but it’s so much faster to begin with that it doesn’t matter. This does become a consideration though if your project doesn’t have as fast a rate of return.

Objection 2: You Could Fail!

This is true, and the main problem with this strategy. While I’m unlikely to lose all the $4,000 immediately when investing it safely, there’s a possibility of losing all of it in an app that no one buys (a common problem).

The best solution to this is to only build things that you have a very high certainty people will pay for. I explain one way to test this in my lifestyle business article, where we sold $10,000 before building anything. In this case, I saw 100+ people per day clicking out to an app similar to Stamena from my site, so I knew I’d immediately have a market.

Objection 3: Why Wouldn’t You Just Follow Conventional Advice?

Most people should, but you have to recognize where conventional advice comes from. If you have a 9-5 job and less experience with projects, then it makes sense to make a safe investment.

What I’m trying to drive home here is that if you aren’t like that, and you do have experience using your money to build things, then don’t not spend money on creating things just because you think you should follow conventional financial advice.

I had to break out of that impulse, and I’m very glad I did.