First Looks: New Protocol I'm Watching

Here’s a new project that I’m keeping my eye on. I’ve already invested a normal “bet size” into it, and might add more later depending on how the project continues to evolve.

It’s a new stablecoin project on Arbitrum called “Vesta Finance.” It’s based on a fork of Liquity, an incredibly successful product on Ethereum.

Vesta is interesting to me for a few reasons:

With the fall of the whole Wonderland / Abracadabra ecosystem, there isn’t a good natively cross-chain borrowing protocol with aggressive debt parameters. Vesta only requires 110% collateral for borrowing against ETH and BTC, and 175% for GOHM.

Do I think you should borrow 90% of your ETH value? No. Do I think other people will and want to? Definitely. And when people go crazy risk-on and get liquidated, that will be good for VSTA holders who I suspect will collect some of the upside in liquidation events.

Vesta is also part of the whole Olympus / Tetranode ecosystem, which means a lot of capital has and will flow into it and support its growth. Olympus has had a rough few months with their token price collapsing, but the amount they’re building and helping build is pretty incredible, and VSTA could become the “Ohm ecosystem stablecoin” in the future.

In terms of their roadmap, their main focuses seem to be on supporting multiple collateral types and extending to other L2s. If they can successfully build a permissionless collateralization protocol for any project to allow VST minting from borrowing against their tokens, that’s an incredibly powerful position to be in. And if they can be the first stablecoin-minting borrowing protocol on new L2s and ZK Rollups, that will be a powerful spot as well.

The last thing is on their tokenomics, where they explicitly say they’re going to pursue some form of veCRV model with lockups and profit sharing. That model has proven extremely successful for the protocols that have adopted it so far, but it’s hard for that dramatic reduction in the circulating supply to be fully priced in before it goes into effect. Here’s the CVX chart to give you an idea. Locking wasn’t introduced until around late August.

Vesta says all of their early allocations will be awarded with a 6 month cliff and then a two year linear unlock, so look out for possible dumps 6 months from this article, around July 3rd.

What I’m Doing

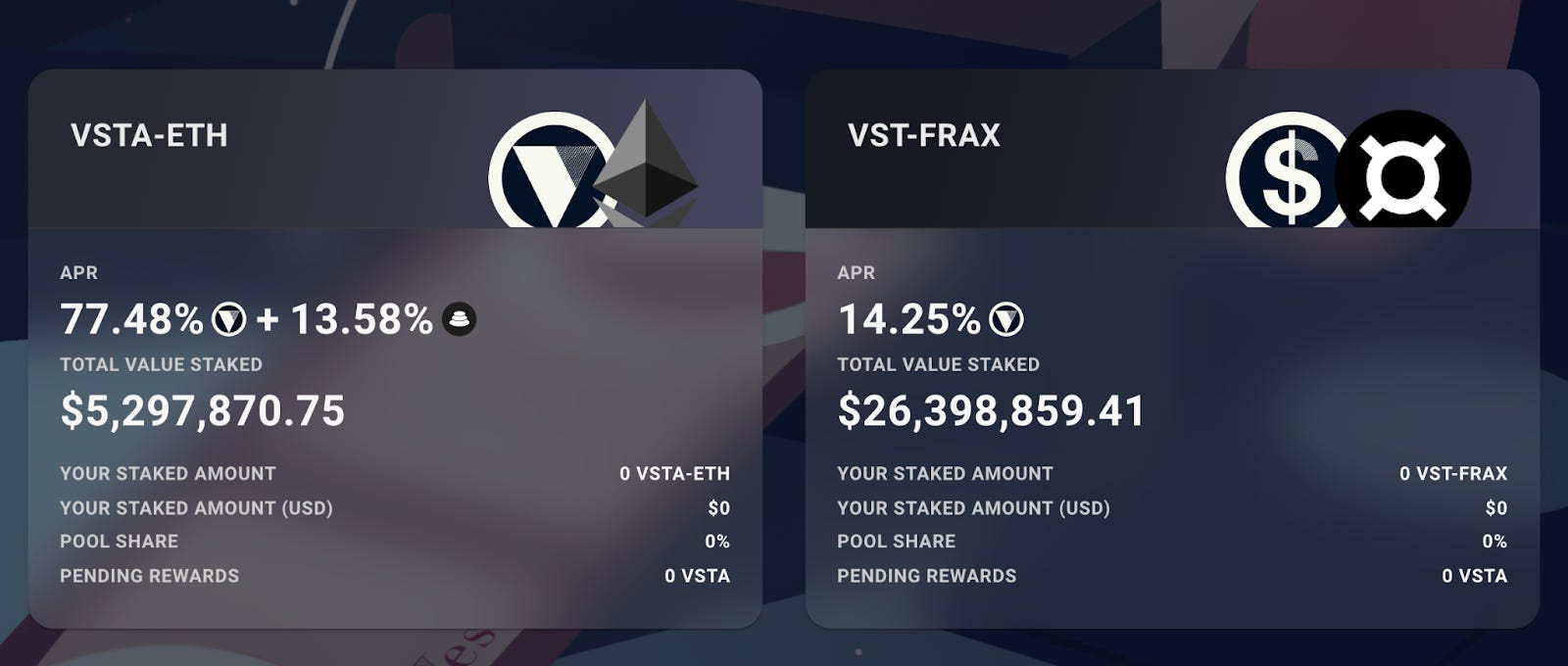

Even with the VSTA token off it’s post-launch peak, the staking rewards for VSTA/ETH are almost 100%:

So I bought that LP on Balancer and staked it, and plan on letting that ride for the foreseeable future.

What might make me adjust is if and when VSTA launches their vote escrowing model with fee-sharing to token holders, and what kind of interest and benefits come with that staking. Until then though I’m happy to just collect more VSTA this way, compound it, and watch the platform develop.

If anything changes, I’ll let you know in a future paying subscriber update.